Spruce users share what’s influenced their financial habits

3 min read

April 03, 2023 • Spruce

Making sense of dollars and cents. That’s the goal of Financial Literacy Month; a time to focus on money management skills, smart habits, and your own financial wellness.

In the spirit of the month, we asked Spruce customers about what’s shaped their behaviors around money.*

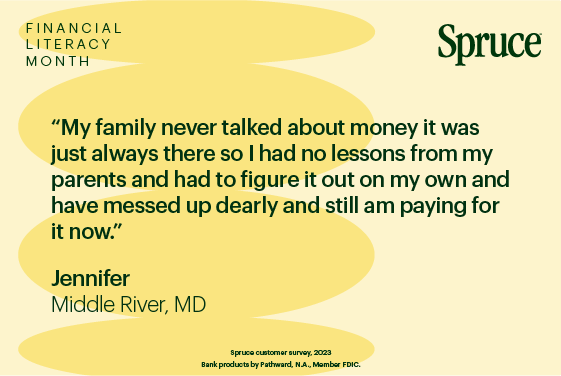

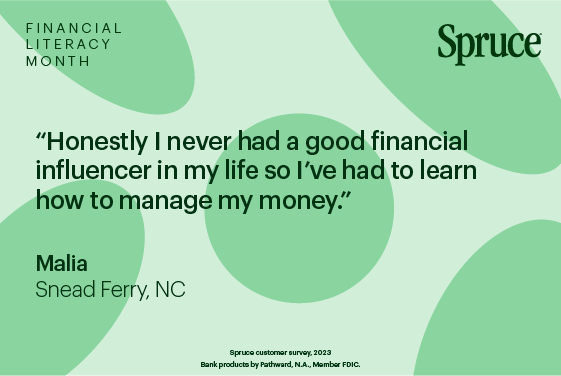

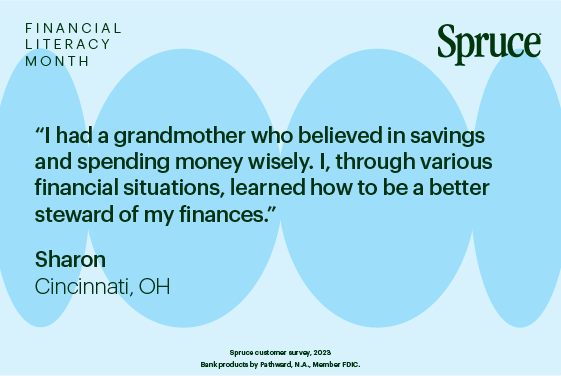

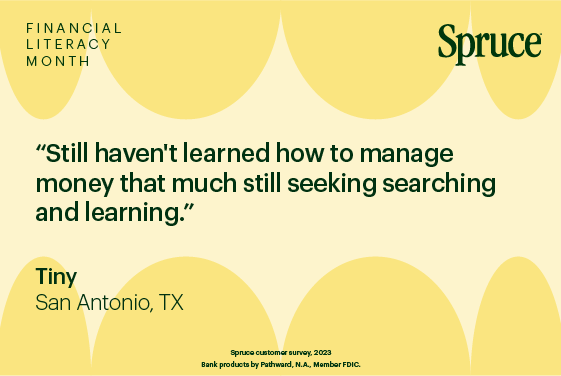

From “we never talked about money” to “my parents taught me a lot” — we heard from many people who had different starting points when it comes to acquiring financial skills.

Perhaps in an ideal world, we’d all learn financial lessons from family, friends, or school, but that was not the case for most.

In fact, of those we surveyed, 84% said they had to figure out money management skills on their own by trial and error.

What’s more, many Spruce users linked being better with money to how much they know. 77% said they felt they could be better with money if they had more financial knowledge.

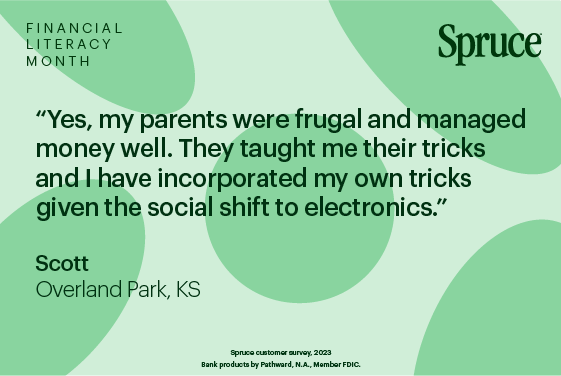

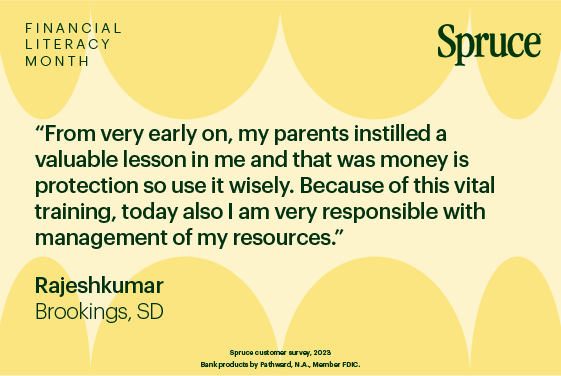

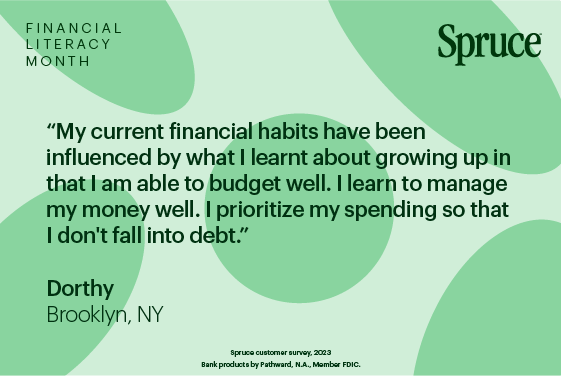

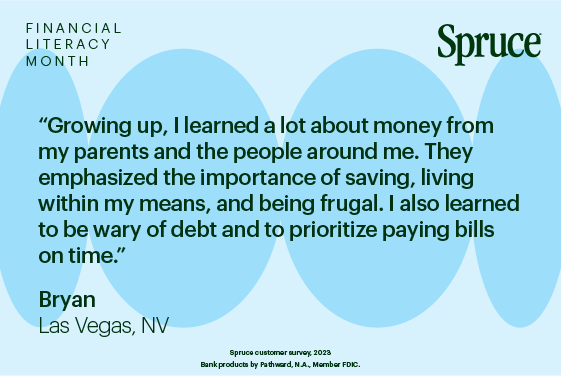

To see what else customers had to share, review the quotes in the gallery below.

Interested in brushing up on your financial skills? Let your journey to financial literacy start here! Check out the financial how-to articles and tips below.

Financial habit influences

We asked Spruce customers: How have your current financial habits been influenced by what you learned about money growing up?

Where to start with financial literacy

Being more financially savvy begins with basics like budgeting, saving, and everyday concepts such as building credit. To help get you started, take a quick dip into these key financial topics, and say yes you can to financial literacy!

Creating a budget

Budgeting can sound scary, but it can also put you in control when it comes to spending. Find out how to create a budget.

Spruce tip: Want automatic insights on your spending habits? Check out Spruce’s budget tracker tool.

Discovering money saving tips

Once you have an eye on your budget and spending, you can see where you may need to pull back in order to save. Review these money saving tips.

Spruce tip: Spruce has saving goals that let you tuck money away in a separate account for big purchases or unexpected expenses.

Building your credit score

Having a rainy day fund and sticking to a budget are two ways to help you stay on top of bills, which in turn can help you build your credit – a key element to helping you qualify for credit cards, loans, etc. Learn how to build your credit score.

Spruce tip: With Spruce, you can monitor your credit score5 for free.

Learn how Spruce can help you be better with money

If you’re ready to put your best financial foot forward this April — or in any month, we’re here for it! Being better with money is what Spruce is all about. See all the ways we can help.

Spruce lets you:

- Monitor your credit score for free.

- Easily tuck money away in dedicated saving goals.

- Get your paycheck up to 2 days early.

- Tap into fee-free overdraft protection up to $20

All this with no monthly fees, no sign-up fees, and no minimum balance requirement. (See Fee transparency)

Find out more about all the features Spruce has to offer.

* March 2023 H&R Block survey of 578 Spruce customers

This information provided for general educational purposes only. It is not intended as specific financial planning advice as everyone’s financial situation is different.

Was this article helpful?