SPENDING ACCOUNT

Get a spending account with no monthly fees.

Take control of your money with a Spruce Spending account and take advantage of no monthly fees, sign up fees, or minimum balance requirements.

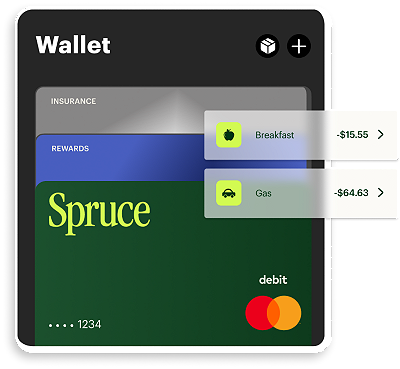

Budget tracking on your terms with Spruce.

The Spruce mobile banking app automatically categorizes your transactions and lets you choose which areas to keep a closer eye on with the Watchlist.

CLEAN UP YOUR FINANCIAL LIFE

Streamline and simplify recurring payments

Pay bills and subscriptions with your Spruce account. Update your info to make Spruce the preferred payment method.

Get instant access to your digital debit card

Add your Spruce digital debit card to to your mobile wallet so you can shop online, provide payment over the phone, or pay in person at a store that accepts digital wallet payments.

You could use this feature as soon as you sign up for Spruce and fund your account. You do not need to wait for your physical debit card.

ATM FINDER

Need cash?

No problem.

Get access to over 55,000 fee-free ATMs nationwide to withdraw money on the go.

An extra layer of protection.

Your Spruce debit card is protected by Mastercard Zero Liability. Shop with peace of mind, knowing you generally won’t be responsible for unauthorized charges if your card is lost or stolen.

Want to learn more?

Visit the resource center for money tips and financial knowledge.

SPUCE MOBILE BANKING APP

Get the Spruce mobile app

Spruce fintech platform is built by H&R Block, which is not a bank. Bank products by Pathward®, N.A., Member FDIC.

FAQs

A spending account is a bank account designed for everyday spending.

Spruce offers the flexibility of accessing your checking account using your debit card through your mobile wallet or the physical card.

Using a spending account can separate your everyday spending from your savings so you can better track your transactions.

There are even more benefits when you open a Spruce Spending account. You get access to Cash Back Rewards1 through debit card purchases from participating retailers and budget tracking tools to monitor and help you better manage your spending.

You can use either your digital or physical Spruce debit card to shop at online retailers just like you would use it in a physical store. You can also use your card to make online payments for things like bills, utilities, and subscriptions.

As soon as your spending account has been created, you can add money and access your digital Spruce debit card info in the Spruce app or by signing in at www.SpruceMoney.com. You can use your digital debit card for online spending and in stores where digital payments are accepted until your physical card arrives in the mail and is activated.

Spruce fintech platform is built by H&R Block, which is not a bank. Spruce℠ Spending and Savings Accounts established at, and debit card issued by, Pathward®, N.A., Member FDIC, pursuant to license by Mastercard®. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Apple and the Apple Logo are registered trademarks of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC. Message and data rates may apply.