ICYMI: 3 ways Spruce is making managing money easy

Spruce News

October 28, 2024 • Spruce

When was the last time you looked at all that Spruce offers? If it’s been a while, you might be surprised to know that we’ve made a few changes to make managing your money easy. Find out more about these features and how you can take advantage of them.

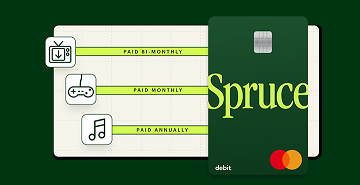

Streamline and simplify recurring payments

You can now update your bills and subscriptions, such as streaming services or utilities, to pay using Spruce, all from one place in the app. This means, you’ll update your default payment info for these items to be Spruce without having to visit other websites. Imagine how easy it can be to streamline your finances! Learn more from our payment switching FAQs.

Integrate your finances more seamlessly

It’s your data and your money, so if you need to share it or transfer it, shouldn’t it be easy? As financial institutions move towards more open banking, you can find ways to integrate your finances more seamlessly.

Here are a few ways you can do that with Spruce:

- View the balance and transactions from your Spruce Spending account in your Personal Financial Management tools along with other accounts.

- Move money from another financial account to your Spruce Spending by linking the account (you can also do the inverse).

- Share digital versions of your Spruce statements with potentials lenders as part of online loan applications via a secure process that you initiate (provided this functionality is available with your lender). Using this method could save you time and additional steps.

Take advantage of earning high-yield interest when you opt in

You can make your savings go further when you opt in to start earning a high-yield savings rate in your Savings account. With Spruce, you can earn 3.50% APY12. on every penny — whether it’s in either of your two interest-bearing saving goals or Extra Savings Account in your Savings Account. Find out how to opt in.

Spruce features available for everyone

All customers are eligible for these features when you sign-up with Spruce. And best of all there are no sign-up fees, minimum balance requirements, or monthly fees!

Not signed up? Get started with Spruce today!

This information provided for general educational purposes only. It is not intended as specific financial planning advice as everyone’s financial situation is different.