Routing number: What it is and how to find yours

7 min read

Spruce

At-a-Glance:

- A bank routing number on a check is a nine-digit code that identifies a financial institution and is used to process transactions like checks, direct deposits and electronic payments.

- Routing numbers vary by bank and transaction type and may change due to events like mergers or branch closures.

- You’ll need your routing number, along with your account number, to set up direct deposit, transfer money between banks, or use peer-to-peer payment apps.

- On a paper check, you can find the routing number on the bottom left. You also might find your routing number through your bank’s website or app, on your bank statement, by contacting customer service, or using the ABA’s routing number lookup tool.

Banking tends to be filled with a lot of specialized words and phrases. It can sometimes feel like a new language you need to learn. “Routing number” is one term you may have heard before, but you may not be super familiar with what it is and where to find it if you need it.

No need to worry, Spruce has you covered! Think of us like your money matters bestie. We’re here to help you learn the money management concepts you need to get better with your finances—no judgement, just trust. Not only that; Spruce comes with loads of helpful features you can use to manage your money.

What is a bank routing number?

A bank routing number is a nine-digit number that identifies your bank. The American Bankers Association (ABA) developed them way back in 1910 to simplify check processing between banks, so they are sometimes referred to as “ABA routing numbers.” They make transactions quicker and more efficient, and they reduce the chance of errors when money is transferred.

Each routing number is unique to the financial institution it represents. It’s a bit like an address that allows banks to know exactly where to send and receive money. The largest national banks may have more than one routing number. And it is common for banks to have different routing numbers for different types of transactions. They might have one for electronic payments and a different one for checks.

Today, routing numbers are used for many purposes, including cashing checks, direct deposit, wire transfers, and setting up peer-to-peer payments through apps like Venmo.

Note that routing numbers can change. If your bank has undergone any big changes, such as merging with another institution, reorganizing operations, or closing branches, check to confirm your routing number before using it and order new checks if necessary.

Routing number vs. account number

Both the routing number and the account number appear on paper checks and it’s important to understand the difference. While the routing number identifies your bank, the account number identifies the specific account you are using to transfer or deposit funds.

The account number on paper checks is most commonly tied to a checking account. Each type of account has its own number, so if you are trying to transfer funds from another account, like a savings account, you’ll need to confirm with your bank the routing number for the account you are working with.

When do I need to use a routing number?

One common reason you might need your bank routing number (and account number) is when setting up direct deposit, your employer will ask for your routing number, so they know which bank to send your paychecks to.

You may also need to know your routing number when:

- Filing taxes, if you want your refund direct deposited into your bank account.

- Transferring money between accounts at two different banks.

- Paying by electronic check.

- Setting up recurring transfers, like automatic bill or loan payments.

- Directly transferring funds to or from your bank account, like during a wire transfer.

- Making payments from your account by telephone.

- Reordering checks.

- Receiving Social Security or other government funds you want direct deposited into your bank account.

- Setting up an account with a peer-to-peer transaction service like Venmo or Zelle.

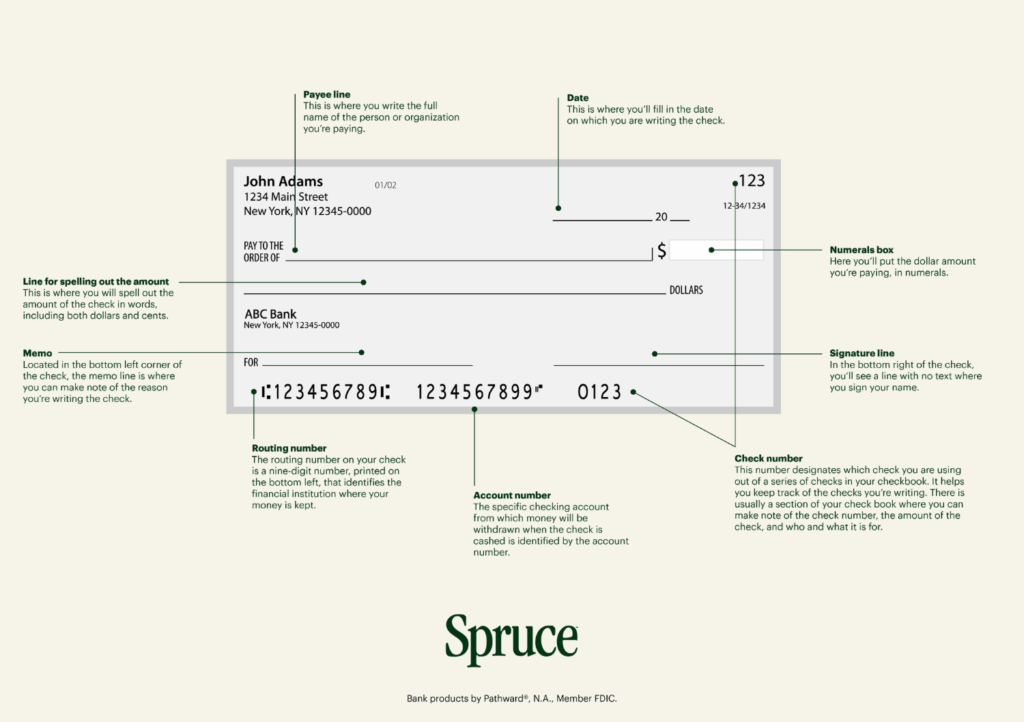

Where is the routing number on a check?

Luckily, you don’t have to be a detective to find your routing number. It’s easily findable on the bottom left side of your check below the signature and memo lines. (Not sure what the signature and memo lines are? Check out our guide on how to write a check.)

Your account number is to the right of the routing number. And next to that is your check number, which helps you keep track of which check you’re writing. These numbers are clearly separated so you can easily determine which is which.

Routing numbers typically start with a 0, 1, 2, or 3, which can be a clue that you’ve pinpointed yours. But be aware that numbers may vary among some financial institutions. A credit union might use a different set of numbers, for example.

Because a routing number identifies the financial institution funds are going to, it’s a crucial piece of information to have when it comes to cashing checks. When you deposit checks online, make sure to snap a photo of the entire check, including the routing number at the bottom.

How to find your routing number without a check

For many people, using checks has all but gone the way of the dinosaurs. But don’t worry: If you don’t have access to a paper check, there are other ways you could find your routing number, including:

- Online. Unlike account numbers, routing numbers are public, and banks are required to share them with you. You may be able to find yours online or through your bank’s mobile banking app under “account information” or “account summary.” If you take this route, be sure to get information directly from your bank’s website, since other sites may be outdated or just plain incorrect.

- Your bank statement. Not all banks include routing numbers on statements, but some do. If yours does, you’ll find it on electronic bank statements or the monthly paper statement you may receive in the mail.

- Through customer service. When in doubt, call your bank or their customer service line and ask them to provide you with the routing number.

- Third party. The American Bankers Association provides a routing number lookup tool.

If you have Spruce checks, you can easily find the routing number in the bottom left corner. You can also find your routing number in the app on the Spending tab by clicking “Card and Spending Account” on the top of the screen.

How Spruce can help you with money management

If you don’t deal with checks every day (and really, who does?), you could benefit from using Spruce features to manage your money digitally with tools like:

- Saving goals with the option to automatically set money aside for an emergency fund or other big purchase.

- An automatic budgeting tracker to see where your money is going.

- Direct deposit.

- No monthly fees

- Access over 55,000 fee-free ATMs nationwide

- Getting paid up to 2 days early.

Start an account with Spruce today

You can count on Spruce to help you learn the basics of money management, so you can feel more confident with money. With tools like an automatic budgeting tracker and saving goals, Spruce can help you develop better money management habits.

Get started with Spruce today!

This information is provided for general educational purposes only. It is not intended as specific financial planning advice as everyone’s financial situation is different.

Was this article helpful?